1% Increase in Income Equals 2.6% Reduction in Expenses

1% Increase in Income Equals 2.6% Reduction in Expenses

Guest writer Ron Wilson dives into the financial management scene with this week’s blog: 1% Increase in Income Equals 2.6% Reduction in Expenses. He even touches upon something Ron Slee mentions frequently: the downside of discounts.

During complicated economic times businesses tighten up on expenses, spending, and accounts receivable.

Rafi Mohammed, in his book “The 1% Windfall” provides an additional effort that can assist in meeting the needed changes to the bottom line.

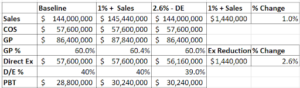

Basically, the concept revolves around increasing income by 1%, without increasing the cost of sales, or reducing direct expenses.

The example below shows that a 1% increase in sales (without impacting cost of sales or direct expense) equals a 2.6% reduction of direct expenses. Apply your organization/department gross profit and pretax percentage to see the impact it has on your own organization.

We have all been through the difficult experience of reducing direct expenses, and it can be very painful.

Here are a few examples that can help to make a positive impact on sales without adjusting the direct expenses areas.

Current Status of Discount Programs– often discount programs are provided to customers based on a request from a salesperson. No doubt the programs may have been needed at a specific point in time, but a review of discount programs may show discounts being given that are not providing the expected increase in sales. Often the OEM provides some type of shared discount program over a specific timeframe. It is important to verify customers’ discounts reflect the OEM’s current program. An OEM may discontinue a rebate program and the dealer may not have applied the same changes and unintentionally may be caring the full burden of the discount being provided to the customer.

Effectiveness of Discount Programs-Verify the discounts are providing the expected results, which is usually increased volume, or expanded use of other products and services within the dealership. If the discount program was not effective, a different approach may need to be reviewed with the sales representative.

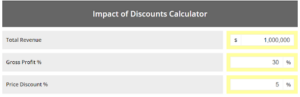

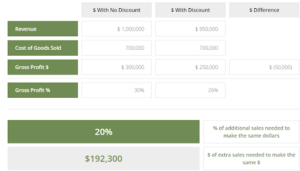

Below is a handy website that shows the impact discounting has on gross profits.

The example below applies to a 10% discount on $1 million in sales. Sales need to increase 20% to make up the same dollars.

https://www.growthforce.com/blog/how-giving-discounts-can-destroy-your-business-profits

This can be a great tool to share with the sales representatives when discussing providing a customer with a discount. What can be expected in increase volume over time?

Providing Repair Options can offset the discount a customer is wanting on a component rebuild, for example. Rebuild options providing a “good-better-best” offering can accomplishing the customers rebuild needs within a specific price range. The variable rebuild options allows the dealer to rebuild a component that meets the level of rebuild needed by the customer within a selected price range. The repair options eliminate the “discount” of a full rebuild while providing a price based on the level of rebuild needed by the customer.

Value Based Pricing requires understanding the customers’ needs and priorities. For example, a customer is focused on reducing the hazards/injuries related to changing ground engaging tools (GET) on a piece of mining equipment. Promoting reduction of the number of GET changes will contribute to reducing the hazards as well as downtime to complete the GET change out. It may not always be about the dollars and cents.

When developing value statements your existing customers can be a great resource to find out what value you bring. Ask your customer to explain the real value of your offer. This will provide a view of their perspective, while building relationships with customers and at the same time it gives you a chance to learn an incredible amount of invaluable information.

Below is an example of a value statement that has identified four areas of importance to the customer. This information was taken from an ESCO GET (Ground Engaging Tool) promotional piece. As can be seen there is no discussion about “discounts,” the discussion is related to “value add” offerings:

Increased Machine Availability

- Superior alloys and optimized system profile result in longer-lasting components

- Simple, intuitive locks provide safer, faster parts replacement.

- Reliability and wear life unmatched in the industry keeps machines operating with minimal downtime.

Lower Maintenance Costs

- Proprietary alloy, increased lip protection and large bearing areas extend operating intervals.

- Longer lasting and more dependable G.E.T. reduces planned and unplanned service events.

- Quick and easy parts replacements by fewer crew members, with no hot work required.

- Shrouds and adapters are engineered to protect more of the Nemisys lip leading edge, extending the service life between lip rebuilds by up to 70%

- Improved wear metal placement increases shroud life by up to 30%

Lower Total Parts Expense

- Longer lasting and more dependable G.E.T. results in fewer parts purchased versus competitors.

- Fewer parts purchased reduces mine site inventory to ship, stock and manage.

Improved Safety

- Keep your crew away from crusher maintenance through superior locking systems that keep teeth and shrouds on the lip.

- Safer installation and removal with integrated pry points and compatibility with the ESCO SecureLift™ system

Best of Both Worlds

1% increase in Sales Without increasing Cost of Sales to Improve the Bottomline: It would be unrealist to think the 1% increase model is the only option. No doubt there needs to be a combination of both direct expense management and reviewing the pricing models and programs currently in place. Below are some pros and cons that will show the importance of combining the two:

Advantages of the 1% Increase in Sales to Improve the Bottom Line:

- Incremental growth may seem small but overall can have an enormous impact on the bottom line.

- Growth in the business comes from income growth, not from reducing expenses.

Disadvantages of the 1% increase in Sales to improve the Bottom Line:

- The 1% increase is not guaranteed and takes time to implement. Reviewing and developing impactful value statements takes time and resources to research, understand, and develop.

- Takes time to implement, communicate, and evaluate the results of the changes implemented.

Reducing Direct Expenses to Improve the Bottomline:

- Has an immediate impact depending on how drastic the effort?

- May improve efficiencies through improvement/streamlining processes.

- Requires a focus on the core business and focus on what is important.

The best Solution is a Blending of the Two:

Take some time to review the various recommendations provided in “The1% Windfall”, while reviewing the rest of your key performance indicators, to provide a balanced improvement to the overall financial results.